We'll help you multiply your QSBS exemption to protect $20m

Valur’s tax strategy software and services handle the details so you can focus on building your wealth

We can help if you

Have startup shares

Own a small business

Expect $10M+ gains

We help you pick a strategy

You focus on what you do best. We handle everything else, from strategy identification to quantitative modeling, legal setup, and ongoing management.

Understand the choices

Use our guided planning engine to explore and understand the strategies that apply to your circumstances.

Evaluate the potential returns

Our state-of-the-art calculators answer the question on everyone's mind: Will these strategies save me money, and how much?

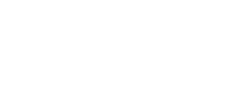

Execute your chosen strategy

Once you've evaluated the available strategies, there's only one thing left to do: Get started. Our team, aided by proprietary drafting technology, will get you set up within 24 hours, and at no cost.

Planning possibilities for qualified small business stock

These are the strategies that can help you reduce your taxes and keep more

Non-grantor Trust

Create trusts to multiply QSBS tax exemptions and save on state taxes—especially valuable in high-tax states like California.

Charitable Remainder Trust

Use a CRUT to defer QSBS gains, reinvest pre-tax, and later donate part to charity—enhancing both impact and tax efficiency.

Reduce your tax bill — fast

Our team of experts will help you evaluate the most promising strategies in minutes.